How Mobile Money in Africa is changing People’s lives

Technology is changing the world of economics. The use of Mobile Money has expanded exponentially over the past years and Africa is the epicentre of this approach. But how is Mobile Money in Africa changing people’s lives?

Thousands of Africans are using Mobile Money to pay bills, transfer money, and to get essential daily items. Mobile Money is transforming retail banking in East Africa.

The difference between Mobile Money and Mobile Banking

You may think Mobile Money and Mobile Banking are the same things – don’t worry – many people think they are the same. The differences are not obvious, however, when you understand how they work, certainly you will realise they are very different. Let me break this down for you…

What is Mobile Money?

The key difference between Mobile Money and Mobile Banking is that Mobile Money doesn’t require a traditional bank account or any product from a bank.

Mobile Money is an account linked directly to your mobile phone number and transactions can only be made using a mobile phone. The service is usually provided by your mobile network operator (e.g Vodafone, MTN, Airtel etc).

Mobile Money does not require a smartphone you can use a Mobile Money smartphone app in some cases. It works just like a bank account and allows users to send payments to friends, family and businesses, pay bills, buy top-up or cash out without having an account in a bank.

Mobile Money is particularly prevalent in East Africa, as a result giving easy and affordable access to financial services. It has gained and continues to gain popularity by adding new users.

That is to say, Mobile Money was created especially for people who do not want or cannot access the banking system. It is designed to work without the internet or smartphone.

What is Mobile Banking?

Mobile Banking allows you to perform the same payment services offered by a bank on a smartphone. Each bank has an application designed differently depending on the bank; it enables you to make almost every transaction, without having to visit a bank branch.

Here’s why that difference is important…

A Mobile Banking app needs a smartphone plus the internet for it to work and requires the user to have an account with a financial institution (a bank). It is an excellent alternative to needing to visit a bank branch.

However, Mobile Banking usually has the same or similar costs as the traditional banking system. If you need to transfer large amounts of money, the bank will always be a good alternative. For transferring smaller amounts, Mobile Money is an excellent alternative.

Who started Mobile Money?

If we look back at history, Mobile Money was launched in 2007 by Vodafone Group plc and Safari-com in Kenya. Called M-PESA, it began as a simple way of texting small amounts between users to make micro-finance repayments.

Soon after, other Mobile Money services were launched in the Philippines. This includes SMART Money and Globe GCash. Today Mobile Money has millions of users in multiple countries around the world.

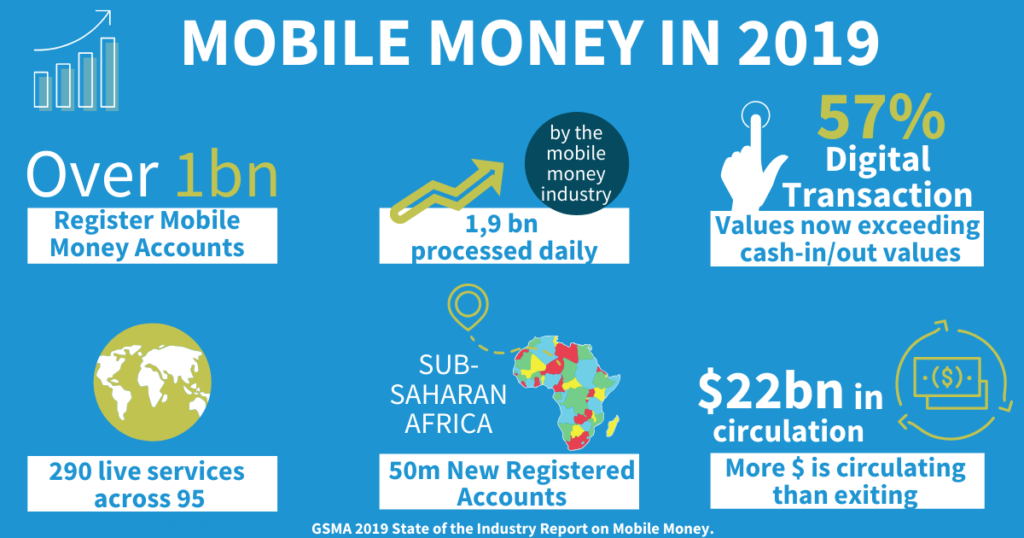

The number of registered mobile money accounts has now exceeded one billion. s a result This is considered a major milestone for the Mobile Money industry so far according to the GSMA Industry Report 2019

M-PESA – the world’s first Mobile Money service

M-PESA changed the way of making payments. Allowing everyday users to make instant electronic payments and transfers using only their ordinary mobile phone phone.

Traditionally, the mobile phone without internet was only useful for making and receiving calls or SMS messages. M-PESA expanded on this by including an option to make payments.

With an M-PESA account, you can: Transfer money, buy products and services, withdraw cash by visiting an agent (usually in a corner shop) and transfer funds to others from your phone. M-PESA makes payments look easy right!

About M-PESA

Where the M-PESA: The M stands for mobile and Pesa means (money) in Kiswahili, the first language of the Swahili people, therefore basically it means Mobile Money.

M-PESA is one of several innovative ideas born out of collaboration between the telecommunications and banking sectors in East Africa. This makes the service a fast, secure and easy way to make payments and handle money.

Above all M-PESA makes it possible for unbanked people to pay for and receive goods and services using a mobile phone instead of utilising a brick-and-mortar bank.

Nowadays the Vodafone M-PESA Mobile Money brand is used in around 10 countries. This includes Mozambique, India, Romania and Fiji and is still growing allowing access to low financial services to millions of people. Click here for more information M-PESA.

How Mobile Money in Africa is changing People’s lives

There is plenty of academic proof that financial inclusion can boost overall economic growth. Mobile Money has become the path to financial inclusion for many emerging markets.

The money protected in a Mobile Money account also allows you to have greater control of expenses and as a result even create an organised budget.

Cash can be lost, damaged or stolen. However, if the money is kept in an electronic wallet it is much safer. On the other hand, not everyone has access to bank products it’s here where Mobile Money plays a key role in being an affordable financial service for everyone due to extremely low transaction fees.

Mobile Money has provided an accessible financial service for all people. Those living in villas do not have to travel to make a payment, unbanked people can now access a product with similar attributes to a bank account. that is how Mobile Money in Africa is changing People’s lives

Why does Kenya lead the world in Mobile Money?

In this section, I’m going to discuss a few reasons why Kenya led the world in Mobile Money. Let’s look at how it all began. Vodafone in partnership with Safaricom the leading telecom operator in the country was the first one to roll out this feature.

Firstly this system was a very convenient way to store and send small amounts of money for those people who couldn’t afford to open a bank account. These people are also called “unbanked”.

Secondly the number of “unbanked” in Kenya is huge since it’s still a developing economy. Mobile Money has become quite popular because people are no longer afraid of their cash being lost or stolen.

Thirdly and most importantly people have started saving their money in M-PESA accounts because it was free to deposit. It is very convenient to withdraw money as there are M-PESA agents at every street corner throughout the whole country.

But that’s not all…

Moreover, Safaricom kept developing this system because M-PESA became a significant revenue source for them. It also enabled them to maintain their dominant market share in a very competitive environment.

Very soon Safaricom started building a platform for retailers to start accepting payments via M-PESA. A retailer can apply for a till number which the customer can use to send the money to the retailer.

Currently, every Kenyan whether educated or not knows how to operate M-PESA. This is a big reason why Kenya leads the world in Mobile Money. If you are looking to send money to Kenya click here.

What is International Mobile Money transfer?

International Mobile Money transfer lets you send money from one country to another person in another country using Mobile Money.

For example, to send money from Australia to your home town overseas, money can be sent instantly to the Mobile Money account of your family, friend or loved one. Money arrives in their local currency.

Who are the people sending money to other countries? Well, in most cases, they are people like you who have made Australia their home temporarily or permanently.

I’m sure you’re with me on this one…

Australia is a beautiful country with open doors and different types of visas that allow many people to immigrate and make their lives here. Being away from home, one way to help family and friends is by supporting them financially.

When we talk about an international money transfer, instantly we may think about costs. Probably the first thing that comes to your mind is that it is an expensive service.

Transferring money to friends and family back home has long been the domain of the giant Money Transfer Organisations (MTO’s) such as Western Union and Moneygram.

However, sending money overseas is now becoming much cheaper and sometimes even free! Certainly, since new fin-tech companies have come to offer alternatives.

Here is some information you should keep in mind when it comes to sending money overseas and understanding currency exchange rates. To better understand how this work takes a look at 5 Reliable Australian Money Exchange Methods.

Advantages of International Mobile Money transfer

1. Instant Speed

The speed of a money transfer has become increasingly important and with Mobile Money the transfer is instantaneous! Faster is impossible.

2. Competitive fees

Traditionally, bank transfers, or traditional channels have higher costs. Mobile Money has the lowest fee costs available and sometimes has no fee.

3. Get it anywhere

The coverage of the service is massive since you only need a cell phone with mobile coverage. It’s true! – International Mobile Money transfer can be received anywhere!

The fastest and most competitive way to send money to Africa

The Rocket Remit money transfer service is the leader in International Mobile Money transfer with funds available instantly to the beneficiary in Africa. To send money, you need just the mobile number of the beneficiary.

About Rocket Remit

We know many of you will send money home while working in Australia.

Rocket Remit is the worlds fastest international money transfer service. Send money instantly to over 38 overseas countries at very competitive rates. Use the country selector to choose the country. Click here for more information on how to send money using Rocket Remit.